Tax Codes

Learning Outcome

On successful completion of this lesson, students will understand how to create new tax codes and how to find existing tax codes.

Lesson

Adding New Tax Codes

- To create a new Tax Code, click on ‘Tax Codes, ‘New’.

- The ‘New Tax Code’ box will open

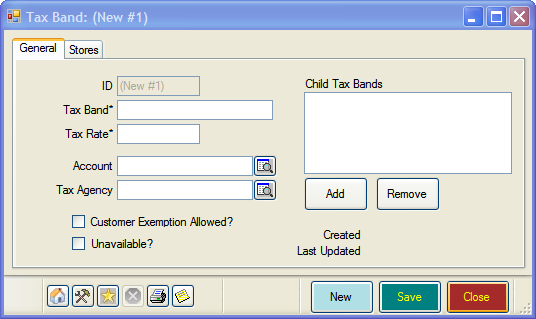

- In the General Tab enter the following

- Tax band – e.g. GST or VAT

- Tax Rate- g. 10%

- Account – If you export to Quickbooks or MYOB, enter the account code for your sales tax.

- Tax Agency – e.g. Inland Revenue

- Customer Exemption Allowed – check this box if you may have customers who are exempt from paying tax.

- Child Tax Bands – If the tax band represents a Tax Group, use Child Tax Bands list to enter any component taxes that comprise the Tax Group.

- In the Stores Tab select the stores that use this tax code (if you have multiple stores).

Finding Existing Tax Codes

- To find an existing Tax Code, click on ‘Tax Codes, ‘Find’.

- Click ‘Search’ in the box that opens and EVE will display a list of all the Tax Codes you use.

- Double-click any Tax Code and more information will be displayed.